9.5 Influence of New Technologies

The television viewing experience has undergone a dramatic transformation in recent years. Gone are the days of being limited to a few channels and a predetermined schedule. Technological advancements have empowered viewers with unprecedented control over what they watch and when they watch it. Streaming services like Netflix, Hulu, and Disney+ have revolutionized the way people consume television. These platforms offer extensive libraries of movies, TV shows, and original content, allowing viewers to binge-watch their favorite series or discover new ones at their own pace. Additionally, the widespread adoption of smartphones and tablets has enabled people to watch television on the go.

While the rise of on-demand services has challenged the traditional concept of prime-time viewing, television consumption remains high. The average American adult watches approximately 5 hours of television per day, which includes time spent watching live TV, recorded programs, and streaming content (Nielsen, 2023). While television audiences have become increasingly fragmented, the amount of time spent watching TV has remained relatively stable. The convenience and flexibility offered by new technologies have contributed to the enduring popularity of television as a form of entertainment. Viewers might not all sit together in the family room watching prime-time shows on network TV between 7 and 11 p.m., but they still watch.

The War Between Satellite and Cable Television

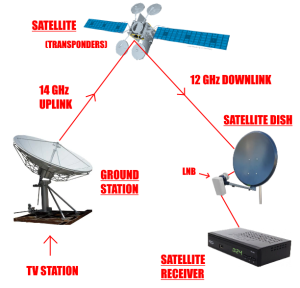

Satellite television can trace its origins to the 1950s space race, when the United States and the Soviet Union competed to launch the first satellite into orbit. Soviet scientists accomplished the goal first with the launch of Sputnik in 1957, galvanizing Americans (who feared falling behind in space technology during the Cold War era) to intensify their efforts, which ultimately led to the creation of the National Aeronautics and Space Administration (NASA) in 1958. AT&T launched Telstar, the first active communications satellite, on July 10, 1962, and the first transatlantic television signal—a black-and-white image of a U.S. flag waving in front of the Andover Earth Station in western Maine—was transmitted that same day. However, the television industry did not utilize satellites for broadcasting purposes until the late 1970s when PBS introduced the Public Television Satellite Service. Satellite communication technology proliferated as a distribution method between 1978 and 1984, with pioneering cable channels such as HBO, Turner Broadcasting System (TBS), and Christian Broadcasting Network (CBN), later evolving into the Family Channel.

Early satellite television systems had a problem that once people purchased a satellite system, they had free access to every basic and premium cable service broadcast via satellite signals. The FCC had an “open skies” policy, under which users had the same right to receive signals as broadcasters had to transmit them. Initially, most families found the cost of the satellite receiver, which exceeded $10,000, prohibitively expensive. However, as the price of a satellite dish dropped to around $3,000 in the mid-1980s, consumers began to view satellite TV as a more affordable, higher-quality alternative to cable. Following the initial purchase of a dish system, the actual programming—consisting of more than 100 cable channels—became available for free. Cable broadcasters lobbied the government for legal assistance and, under the 1984 Cable Act, were granted permission to encrypt their satellite feeds, allowing only those who purchased a decoder from a satellite provider to receive the channel.

Following the passage of the Cable Act, the satellite industry suffered a significant setback. Sales of the popular direct-to-home (DTH) systems (precursors to the smaller, more powerful direct broadcast satellite systems introduced in the 1990s) that had offered free cable programming slumped from 735,000 units in 1985 to 225,000 units a year later, and around 60 percent of satellite retailers went out of business. The satellite industry’s sudden drop in popularity was exacerbated by large-scale anti-satellite advertising campaigns by cable operators, which depicted satellite dishes as unsightly. Although sales picked up in the late 1980s with the introduction of integrated receiving and decoding units and the arrival of program packages, which saved consumers the time and effort of signing up for individual programming services, piracy —the theft of satellite signals —stunted the industry’s growth. Of the 1.9 million units manufactured between 1986 and 1990, fewer than 500,000 received signals legally (Thibedeau, 2000). The actions of the Satellite Broadcasting and Communications Association (SBCA), an association formed in 1986 through the merger of two trade organizations—the Society of Private and Commercial Earth Stations (SPACE) and the Direct Broadcast Satellite Association (DBSA) —ultimately solved the problem. SPACE’s membership comprises manufacturers, distributors, and retailers of direct-to-home systems, as well as DBSA-represented companies interested in direct broadcast satellite systems. The SBCA established an antipiracy task force, which aggressively pursued illegal hackers with the assistance of the FBI.

Once they had the piracy problem under control, the satellite industry could move forward. In 1994, four major cable companies launched a first-generation direct broadcast satellite (DBS) system called PrimeStar. The system, a small-dish satellite-delivered program service intended explicitly for home reception, became the first successful DBS system to enter the market in the United States. Within a year, PrimeStar beamed 67 channels into 70,000 homes for a monthly fee of $25 to $35 (in addition to a hardware installation fee of $100 to $200). By 1996, competing companies DirecTV and EchoStar‘s Dish Network had entered the industry, and Dish Network’s lower prices forced its competitors to lower their fees as well. DirecTV acquired PrimeStar’s assets in 1999 for around $1.82 billion, absorbing its rival’s 2.3 million subscribers (Junnarker, 1999).

Satellite Television Loses Ground to Streaming Services

The satellite television industry has undergone significant changes in recent years. While DirecTV and Dish Network were once the dominant players, the landscape has become increasingly competitive with the emergence of streaming services such as Netflix, Hulu, and Amazon Prime Video. These services offer a wide range of content at affordable prices, challenging the traditional cable and satellite TV models.

The Satellite Television and Radio Broadcasting Act of 1999 played a crucial role in expanding the reach of satellite TV. By allowing satellite providers to carry local TV stations, the act put them on a more level playing field with cable companies. This helped satellite providers attract subscribers and grow their market share. Satellite companies have historically offered competitive pricing and bundled packages to attract customers. They have often provided access to premium channels, such as HBO and ESPN, at a lower cost than traditional cable providers. Additionally, satellite TV has typically offered a wider range of channels, including international programming.

However, the rise of streaming services has presented a significant challenge to the satellite TV industry. Many consumers have found it more cost-effective and convenient to subscribe to streaming services instead of cable or satellite TV. As a result, the market share of satellite TV has declined in recent years. In 2024, DirecTV announced it would purchase its rival Dish Network for $1 (CNN Business, 2024), however, they eventually terminated the deal. To remain competitive, satellite providers have focused on offering additional features and services, including advanced DVR capabilities, voice control, and integration with other smart home devices. However, the long-term viability of the satellite TV industry remains uncertain as consumers increasingly embrace streaming platforms.

The Impact of DVRs and the Internet: Changing Content Delivery

The television landscape has undergone significant changes in recent years, driven by technological advancements and shifting consumer preferences. The introduction of digital video recorders (DVRs) and streaming services has fragmented audiences and altered how viewers consume content. For example, viewers can set their DVRs to record all new (or old) episodes of the show South Park and then watch the recorded episodes whenever they have free time.

DVRs have empowered viewers to take control of their viewing schedules. By recording programs to view later, audience members can skip commercials and watch content at their convenience. While DVRs initially raised concerns about user privacy, the industry has implemented standards to protect consumer data.

The internet has revolutionized content consumption. Streaming services like Netflix, Hulu, and Amazon Prime Video provide extensive libraries of movies and TV shows, enabling viewers to access content on demand. While online platforms have posed challenges for traditional media industries, television has remained a dominant form of entertainment, and the average American continues to spend a significant amount of time watching television. Despite the growth of streaming services, traditional TV remains a popular medium. Many viewers combine television with other forms of media, such as watching YouTube videos or catching up on missed episodes online.

New Viewing Outlets: YouTube and Hulu

Among the many recent Internet phenomena, few have had as significant an impact as the video-sharing website YouTube. Created by three PayPal engineers in 2005, the site enables users to upload personal videos, television clips, music videos, and movie snippets that other users can watch. Although it initially drew unfavorable comparisons with the original music-sharing site Napster (see Chapter 6 “Music”), which found itself buried under an avalanche of copyright infringement lawsuits, YouTube managed to survive the controversy by forming agreements with media corporations, such as NBC Universal Television, to broadcast video clips from shows such as The Office legally. In 2006, Google purchased the company, which showed more than 100 million video clips per day, for $1.65 billion (MSNBC, 2006). Correctly predicting that the site represented the “next step in the evolution of the Internet,” Google CEO Eric Schmidt has watched YouTube’s popularity explode since the takeover. According to current data, people watch over 1 billion hours of video on YouTube every day, and users upload more than 500 hours of video every minute (YouTube). To secure its place as the go-to entertainment website, YouTube has expanded its boundaries by developing a movie rental service and showing live music concerts and sporting events in real-time. In 2023, YouTube secured the exclusive rights to NFL Sunday Ticket, bringing live out-of-market NFL games to millions of subscribers and showcasing the platform’s evolution into a comprehensive entertainment hub.

While platforms like YouTube initially gained prominence through user-generated content, Hulu emerged as a key destination for commercial videos, particularly current and past seasons of movies and TV shows. Established in 2007 as a joint venture primarily among NBC Universal and News Corp (later 21st Century Fox), Hulu’s initial model offered a library of video content, including full episodes of popular network shows, free of charge, supported entirely by advertising. This approach quickly gained traction, and within a few years, it became a significant player in the online video industry.

However, Hulu’s business model has undergone a profound transformation. It is now primarily a subscription-based streaming service, offering both ad-supported and ad-free tiers, and is wholly owned by The Walt Disney Company, following Disney’s acquisition of 21st Century Fox assets in 2019 and its subsequent buyout of Comcast’s remaining stake in 2025. Today, Hulu remains a U.S.-centric platform, boasting a robust library that includes current-season episodes from Disney-owned networks (ABC, FX, Freeform, and National Geographic), as well as NBCUniversal and others, alongside a growing slate of critically acclaimed Hulu Originals, such as The Bear and Only Murders in the Building. As of 2025, Hulu has grown to approximately 53.6 million paid subscribers and generates billions in revenue, reflecting its successful adaptation to the subscription video-on-demand landscape. While its ad-supported tier still features commercials, the industry has moved beyond simple minute-for-minute comparisons, focusing instead on targeted advertising and integrated brand experiences.

The rise of streaming services like Hulu initially sparked intense debate within the traditional television industry about “cannibalization”—the fear that offering content online would undermine lucrative cable subscriptions and DVD sales. Early disputes, such as Fox temporarily pulling episodes of It’s Always Sunny in Philadelphia or networks refusing to stream certain shows, highlighted these anxieties. However, the industry has essentially come to accept that digital distribution is not just inevitable but essential. The lesson learned from early viral successes, such as Saturday Night Live’s “Lazy Sunday” clip generating millions of YouTube views without NBC directly profiting, underscored the need for networks to control and monetize their digital content. Consequently, major broadcast networks and media conglomerates have either launched their comprehensive streaming platforms or, as in Hulu’s case, consolidated their content onto a powerful, jointly-owned service, recognizing that embracing streaming is crucial for retaining audiences and revenue in the evolving media landscape.

Video-on-Demand

Initially introduced in the early 1990s, the concept of video on demand (VOD)—a pay-per-view system that allows viewers to order or download a film via television or the Internet and watch it at their convenience—did not immediately become successful because of the prohibitive cost of ordering a movie compared to buying or renting it from a store. Studios also often withheld movies until long after they became available on DVD, by which time most people who wanted to view the film had already seen it. Studios have addressed both of these disadvantages by releasing movies simultaneously on VOD and DVD at competitive rental prices. Currently, most cable and satellite TV providers offer some form of on-demand service, either VOD, which provides movies 24 hours a day and enables viewers all the functionality of a DVD player (such as the ability to pause, rewind, or fast forward films), or near video on demand (NVOD), which broadcasts multiple copies of a movie or program over short time intervals but does not allow viewers to control the video.

As a powerful alternative to traditional cable or satellite video-on-demand (VOD) services, viewers now readily obtain movies and television shows over the Internet through a diverse ecosystem of streaming platforms. While free, ad-supported services like YouTube and Pluto TV remain popular, the market is dominated by paid subscription services that stream vast libraries of content. Netflix, for instance, which launched its streaming service in 2007, has grown into a global powerhouse, having fully transitioned from its original online DVD rental service (which was spun off into DVD.com and eventually shut down in September 2023). Similarly, Amazon, which initially offered a pay-per-view model in 2008, has evolved its Prime Video service into a comprehensive subscription offering that includes an extensive content library, original productions, and even live sports. Viewers can also continue to stream free, ad-supported episodes of their favorite shows directly via the websites and apps of broadcast and cable networks.

The increasing ubiquity of smartphones and other mobile devices has profoundly impacted VOD consumption, leading to a significant rise in viewers watching television outside the home. Recognizing that consumers are eager to watch entire TV episodes or even films on their mobile devices, industry executives have aggressively capitalized on this trend. Today, virtually every major streaming service, from HBO Max and Disney+ to Peacock and Paramount+, offers robust mobile applications that provide seamless access to their entire catalogs, often with download capabilities for offline viewing.

The evolving landscape of television consumption has introduced new categories of viewers, primarily defined by their relationship with traditional cable or satellite TV services. “Cord-cutters” are consumers who have intentionally cancelled their conventional television subscriptions, opting instead to access their entertainment and news content exclusively through internet-delivered services, often referred to as streaming platforms. This group typically previously subscribed to cable or satellite and made a conscious decision to switch, driven by factors such as cost savings, on-demand content availability, and personalized viewing experiences. In contrast, “cord-nevers” represent a newer demographic that has never subscribed to traditional pay television services. These individuals, often younger generations, have grown up in an era where mobile devices, wireless internet, and streaming platforms are the primary means of content consumption, making linear broadcast or cable television an unfamiliar or unnecessary concept for them. Both cord-cutters and cord-nevers collectively contribute to the ongoing, significant shift in media consumption away from traditional models, forcing the television industry to adapt rapidly to a fragmented and on-demand viewing environment.

This profound shift from traditional linear television viewing to online, on-demand consumption has made a substantial and accelerating dent in the cable and satellite industry. What was once a “small but noticeable dent” has become a significant disruption to a multi-billion-dollar industry. Between 2008 and 2009, an estimated 800,000 U.S. households cut the cord; however, this trend has dramatically intensified. As of early 2025, approximately 56 million (46%) of U.S. internet households identify as “cord-cutters” who have abandoned traditional pay-TV, with an additional 12% being “cord-nevers” who have never subscribed. The high cost of conventional cable primarily drives this mass migration, as well as the flexibility of streaming and the sheer volume of content available online, which fundamentally reshapes the media landscape.

Interactive Television

Moving beyond simple video-on-demand, the concept of interactive television (iTV) has evolved dramatically, seamlessly integrating traditional viewing with dynamic online content to create a multifaceted entertainment experience. Today, this interactivity is primarily driven by smart televisions with built-in operating systems and a vast array of streaming applications, rather than external set-top boxes. Viewers can now effortlessly engage with content through features like integrated polls and quizzes during live events, access real-time statistics and highlights directly within streaming apps during sports matches, create personalized watchlists, or participate in interactive narratives offered by select streaming originals. Beyond the television screen itself, the “second-screen” phenomenon has become pervasive, with viewers routinely using smartphones, tablets, and laptops to simultaneously engage with social media platforms like X (formerly Twitter), Facebook, Reddit, and TikTok, discussing shows in real-time, participating in fan communities, and accessing supplementary content. This widespread concurrent use allows for a rich, shared viewing experience, where marketing strategies often involve encouraging live social engagement or providing exclusive behind-the-scenes content on companion digital platforms. The industry’s initial skepticism about “Internet-like experiences” on TVs has vanished, as virtually all new televisions are now internet-enabled, making deep interactivity and multi-device engagement the new standard for modern television consumption.